topooo.ru News

News

How Much Is My Credit Card Interest

The majority of credit card issuers compound interest on a daily basis. This means that your interest is added to your principal (original) balance at the end. Some scammy debt relief companies promise to get you a lower credit card interest rate, claiming they can save you thousands of dollars. How do I calculate my monthly APR? · Find your current APR and balance in your credit card statement. · Divide your current APR by 12 (for the twelve months of. Lower Interest Rates by Consolidating Credit Card Payments · Debt management programs, offered by nonprofit credit counseling agencies, can lower interest rates. Credit Card Interest · Interest is charged on a daily basis for the outstanding amount · Any interest not settled by the next payment due date will also attract. Credit card interest is the amount you'll pay, on top of what you spent purchasing items and services, if you leave an unpaid balance on your credit card. Use this credit card interest calculator to determine how much interest you'll pay on your credit card balance. This page will help you better understand your Credit Card including your APR and interest rate, as well as making statement payments and spreading the cost of. Just input your current card balance along with the interest rate and your monthly payments. We'll help you determine how many months it will take to free. The majority of credit card issuers compound interest on a daily basis. This means that your interest is added to your principal (original) balance at the end. Some scammy debt relief companies promise to get you a lower credit card interest rate, claiming they can save you thousands of dollars. How do I calculate my monthly APR? · Find your current APR and balance in your credit card statement. · Divide your current APR by 12 (for the twelve months of. Lower Interest Rates by Consolidating Credit Card Payments · Debt management programs, offered by nonprofit credit counseling agencies, can lower interest rates. Credit Card Interest · Interest is charged on a daily basis for the outstanding amount · Any interest not settled by the next payment due date will also attract. Credit card interest is the amount you'll pay, on top of what you spent purchasing items and services, if you leave an unpaid balance on your credit card. Use this credit card interest calculator to determine how much interest you'll pay on your credit card balance. This page will help you better understand your Credit Card including your APR and interest rate, as well as making statement payments and spreading the cost of. Just input your current card balance along with the interest rate and your monthly payments. We'll help you determine how many months it will take to free.

Annual percentage rate (APR) refers to the yearly interest rate you'll pay if you carry a balance on your credit card. · Some credit cards have variable APRs. Interest rate for your credit card. The length of time to pay off this credit card may be much greater than calculated if you enter a low promotional interest. A lower interest rate credit card can help you save on the cost of debt by making it easier to pay down your balance faster. If your credit card account has a variable rate, the credit card rate is tied to an index. This index rate can change periodically. The bank can change your. Investopedia's database reported an average credit card interest of % as of March How Do You Avoid Paying Interest on a Credit Card? There is only. Fees and interest rates · Annual fees and finance charges can significantly increase your credit costs. · Backdated Interest · Generally, when you charge an item. The purchase rate is the interest rate applied to credit card purchases and only applies to unpaid balances at the end of the billing cycle. The average daily. How to calculate credit card interest · Locate your balance, current APR and number of days in your billing cycle on your credit card statement. · Divide your APR. How do you calculate interest on a credit card? · Divide your APR by (the number of days in a year) to get your daily periodic rate. · Multiply that number by. You only pay interest on a credit card when you carry a balance, so you don't need to worry about your interest rate (no matter how high) if you feel absolutely. Credit card interest is a fee that you're charged when you carry a balance on your credit card from one billing cycle to the next. Current credit card interest rates ; 7/10/, % ; 7/3/, % ; 6/26/, % ; 6/19/, %. The average APR offered with a new credit card today is %, up from % last month. Category, Minimum APR, Maximum APR, Average, Previous month. Average. The average credit card interest rate is % for new offers and % for existing accounts, according to WalletHub's Credit Card Landscape Report. This credit card interest calculator figures how much of your monthly payment is applied to principal and how much is interest. You can figure out how much interest you will pay on your credit card by dividing the card's APR by and multiplying first by your average daily balance and. Use the credit card interest calculator below to see how you can pay off your debt more quickly or how much you can save with debt consolidation loans and zero. Banks and credit card issuers use an APR formula to determine how much interest borrowers must pay on their outstanding balances. APR can be calculated daily or. Work out how much interest you may pay on a credit card balance, based on your interest rate and monthly payments. The formula to determine how much interest you owe on your outstanding balance may vary by creditor, but generally works like this: Let's say your credit card's.

High Interest Savings Account 1 Million

With a bond paying a 2% interest rate, a $1 million investment could earn you $20, per bond pay interest income annually. High-interest savings accounts. Similarly, if the minimum monthly balance is EGP 1 million then the corresponding interest rate of % from the table below will apply to the entire EGP 1. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. For parents with kids and teens, explore Chase High Chase serves over 82 million consumers and million small businesses with a broad range of financial. TBills or other savings bonds would run around %, but typically on a one year return so you can't typically take them out prior to that. Some. Earn and save more with % APY1. Earn 8x the national average APY Our savings calculator shows you how our competitive interest rate grows your. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. Business Advantage Account, %. US$ Business Advantage Account, %. All-In Banking Package rates1. High-Interest Savings Account, %. Everyday Banking. We compared 73 online savings accounts offered by 53 nationally available banks and credit unions to find the best 5% interest savings accounts. With a bond paying a 2% interest rate, a $1 million investment could earn you $20, per bond pay interest income annually. High-interest savings accounts. Similarly, if the minimum monthly balance is EGP 1 million then the corresponding interest rate of % from the table below will apply to the entire EGP 1. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. For parents with kids and teens, explore Chase High Chase serves over 82 million consumers and million small businesses with a broad range of financial. TBills or other savings bonds would run around %, but typically on a one year return so you can't typically take them out prior to that. Some. Earn and save more with % APY1. Earn 8x the national average APY Our savings calculator shows you how our competitive interest rate grows your. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. Business Advantage Account, %. US$ Business Advantage Account, %. All-In Banking Package rates1. High-Interest Savings Account, %. Everyday Banking. We compared 73 online savings accounts offered by 53 nationally available banks and credit unions to find the best 5% interest savings accounts.

Seriously. Trustpilot reviews. 1 million + customers globally. $60 Nobody likes paying fees, even for a savings account with high interest. So. Use our High Interest Savings account to earn up to % APY on balances up to $2, No matter which free savings account you choose, you'll enjoy the. With a 5% interest CD (Certificate of Deposit), your annual interest earned on $1 million would be $50, If you're seeking higher returns, you could invest. Money market funds can give you the opportunity to get a better return on your cash, including your emergency fund, money sitting in a savings account, or a. With the Bask Bank Interest Savings Account, you can earn % APY with no monthly account fees. It doesn't have a minimum balance or deposit requirement;. The interest would be $10, on total deposits of $22, (Review NerdWallet's round-up of high-yield savings accounts and CDs to see how much interest you. Bankrate's picks for the top jumbo money market rates · First Internet Bank – % APY, $1,, minimum balance for APY · America First Credit Union – Similarly, if the minimum monthly balance is EGP 1 million then the corresponding interest rate of % from the table below will apply to the entire EGP 1. Earn a monthly bonus interest on savings between £25, - £1 million when you leave your balance untouched; Open your account online in 10 minutes. Bread Savings High-Yield Savings Accounts offer highly competitive rates, interest Maximum deposit limit of $1 million per account and $10 million limit per. Compare various options of savings bank accounts to find best high interest saving account for you among all savings bank account interest rates. A $1 million investment in a money market account could earn you $5, per year in interest income. Another great option you can explore is the Lyons Enhanced. TBills or other savings bonds would run around %, but typically on a one year return so you can't typically take them out prior to that. Some. interest earned on your savings. For too long, this money has gone toward their interests, and not yours. Insured up to $5 million. The M1 High-Yield Savings. Keep in mind that the APY on savings accounts can fluctuate without warning, so if you want to lock in a high interest rate for an extended time, you may want. higher than the interest earned in your average sweep or savings account. The maximum total deposit for J.P. Morgan Premium Deposit is $3 million per account. Seriously. Trustpilot reviews. 1 million + customers globally. $60 Nobody likes paying fees, even for a savings account with high interest. So. Maximize your savings with a high interest account. CIBC eAdvantage® Savings Get Regular Interest1 on all balances. Daily Closing Balance, Regular. Relationship rates available. Earn a Relationship Interest Rate 1 when you link your Platinum Savings account to an eligible checking account. Flexible access.

Can You Balance Transfer Care Credit

You can transfer a balance from another credit card or a personal, student or auto loan to your Capital One credit card account online. The 0% introductory APR does not apply to cash advances and is valid for the first 15 billing cycles on purchases and balance transfers. Thereafter, the APR may. You may have to pay a balance transfer fee every time you transfer a balance using your card The fee is often around 3% or more of the amount you transfer. If you are approved, we may permit you to transfer balances from other eligible credit cards or accounts up to the amount of your credit limit we make. On the Account Summary page, select the three dots next to the credit card from which you'd like a Balance Transfer. From the “I want to” drop-down menu, select. The following transactions do not qualify for Reward Points: Cash advances, balance transfers (when available), finance charges and fees. From time to time, you. As a valued CareCredit cardholder, we want to make it as easy as possible to update your account, view balances and make payments. Now you can view and manage. Transferring a credit card balance can help you to lower the cost of your credit card borrowing and consolidate multiple debts. You can choose to stop receiving “prescreened” offers of credit from We will charge this fee for each balance transfer you make. Cash Advance Fee. You can transfer a balance from another credit card or a personal, student or auto loan to your Capital One credit card account online. The 0% introductory APR does not apply to cash advances and is valid for the first 15 billing cycles on purchases and balance transfers. Thereafter, the APR may. You may have to pay a balance transfer fee every time you transfer a balance using your card The fee is often around 3% or more of the amount you transfer. If you are approved, we may permit you to transfer balances from other eligible credit cards or accounts up to the amount of your credit limit we make. On the Account Summary page, select the three dots next to the credit card from which you'd like a Balance Transfer. From the “I want to” drop-down menu, select. The following transactions do not qualify for Reward Points: Cash advances, balance transfers (when available), finance charges and fees. From time to time, you. As a valued CareCredit cardholder, we want to make it as easy as possible to update your account, view balances and make payments. Now you can view and manage. Transferring a credit card balance can help you to lower the cost of your credit card borrowing and consolidate multiple debts. You can choose to stop receiving “prescreened” offers of credit from We will charge this fee for each balance transfer you make. Cash Advance Fee.

Balance transfer credit cards offer interest-free periods, often 12 to 20 months, that you can use to pay off high-interest credit card debt faster than. *If you are approved as a CareCredit cardholder, you will pay no Finance Charges on the balance for promotional means (including balance transfer checks) we. We've got answers to all your Synchrony-related questions — from how to replace a stolen card to why you should know your credit score, and everything in. Transferring balances can potentially lower your total interest and simplify your payment schedule, helping you pay off your balances(s) faster. However, it's. Promotional financing is using a credit card to pay for big-ticket items and then paying the promo balance off over a period of time. It's all about transferring a high-interest credit card balance to a new, low-interest card, and it has the potential to save you a lot of money in the long. Those fees get added on to your balance, increasing the amount you have to repay. A balance transfer may not save you money on interest if you're not able to. You can easily move the balance from another credit card to your Navy Federal Credit Card. If you don't have one yet, check out our options or see if you're. The minimum balance transfer amount allowed is $ Any balance transfer request that is submitted for less than $ will not be honored. If you default. And that's in part because of its promotional financing options, which involve no interest charges if you pay the balance off in full within six, 12, 18 or In some sense, the CareCredit card works just like a regular credit card. The only difference is that you can only use it to cover traditional medical insurance. How can we help? · CareCredit Cardholders: Call () · Apply for CareCredit: Call () · Enrolled Providers accepting CareCredit · Interested in. Can I do a Balance Transfer between USAA credit cards? Can I still do a balance transfer if my card has been lost or stolen? transfer balances from your other credit card accounts to this account. Unless we tell you otherwise, we will treat balance transfers as purchases. We. Dedicated support you can rely on for your business. Find answers to the most frequently asked questions about CareCredit's financing solution. You can transfer balances from credit cards at other institutions to your Consumers Mastercard® credit card. You'll probably save money in the process! There's no transfer fee, and we take care of all the paperwork. Your other credit card accounts will not be closed (even if you transfer the entire balance). Balance transfers can have positive credit score effects if you open a single new card with a low APR and make an effort to reduce your debt. CK Editors' Tips††: Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower.

How To Allow Overdraft Bank Of America

Your credit card must be confirmed; if not confirmed, no money will advance to cover the overdraft. Once your credit card has been confirmed, please allow up to. It's "off" by default. You have to give positive consent in writing to enable overdraft protection on a bank account. If you didn't do that and. If your account is overdrawn, you must immediately bring your account to a positive balance. We pay overdrafts at our discretion and we reserve the right not to. If you want us to authorize and pay overdrafts or update your preferences on ATM and everyday debit card transactions, call (Dial for TTY/TRS). In general, for debit card transactions at ATMs or at merchants, consumers must opt-in, or agree up front, that the bank can charge you an overdraft fee for any. If you want us to authorize and pay overdrafts on ATM and everyday debit card transactions, complete the form below and press the Submit button. You may be able to authorize an overdraft and access cash at a Bank of America. ATM. You'll pay a $35 Overdraft Item fee for the ATM withdrawal unless you. Bank of America Advantage SafeBalance Banking® provides a straightforward, easy-to-use experience that lets you focus on the basics. There are no overdraft. authorize and pay the item and overdraw your account (an overdraft item),1 or decline or return the item unpaid (a returned item). When this happens, you. Your credit card must be confirmed; if not confirmed, no money will advance to cover the overdraft. Once your credit card has been confirmed, please allow up to. It's "off" by default. You have to give positive consent in writing to enable overdraft protection on a bank account. If you didn't do that and. If your account is overdrawn, you must immediately bring your account to a positive balance. We pay overdrafts at our discretion and we reserve the right not to. If you want us to authorize and pay overdrafts or update your preferences on ATM and everyday debit card transactions, call (Dial for TTY/TRS). In general, for debit card transactions at ATMs or at merchants, consumers must opt-in, or agree up front, that the bank can charge you an overdraft fee for any. If you want us to authorize and pay overdrafts on ATM and everyday debit card transactions, complete the form below and press the Submit button. You may be able to authorize an overdraft and access cash at a Bank of America. ATM. You'll pay a $35 Overdraft Item fee for the ATM withdrawal unless you. Bank of America Advantage SafeBalance Banking® provides a straightforward, easy-to-use experience that lets you focus on the basics. There are no overdraft. authorize and pay the item and overdraw your account (an overdraft item),1 or decline or return the item unpaid (a returned item). When this happens, you.

In general, for debit card transactions at ATMs or at merchants, consumers must opt-in, or agree up front, that the bank can charge you an overdraft fee for any. However, for the DebitPlus feature, you need to opt in to authorize us to authorize and pay overdrafts for your everyday debit card or ATM transactions. North America. Canada (English) · Canada (Français) · United States. Latin The proposed rule would allow large banks to provide: (i) courtesy overdraft. ➢ What if I want American Savings Bank to authorize and pay overdrafts on my ATM and everyday (one-time) debit card transactions? If you also want us to. You activate an overdraft facility when a check is presented for payment for an amount greater than the amount in your checking account. You can use your own funds to cover the overdrawn balance using one of your companion accounts. The bank gives you access to additional funds (subject to credit. With overdraft protection, even if the account has insufficient funds, the bank will cover the shortfall so that the transaction goes through. When a customer. If you bring your available balance to at least $0, we will not assess any Overdraft Fees. If you do not use Extra Time to make a deposit, or if your deposit is. Make sure your available balance is at least $0 by depositing enough to cover the overdrawn balance plus any additional transactions (for example, a scheduled. Enroll in our Courtesy Overdraft Service With our Courtesy Overdraft Service, you can set up your account to allow any ATM or one-time debit card transactions. Savings Overdraft Protection · No transfer fees. Choose this optional service to link your checking account1 with a savings account · Cover transactions up to. Savings Overdraft Protection · No transfer fees. Choose this optional service to link your checking account1 with a savings account · Cover transactions up to. Overdraft Privilege Opt-In for debit card transactions—Allows checks, automatic withdrawals, ACH, and debit card transactions to clear your account. Available. Opting in to Overdraft Coverage allows PNC to cover your ATM and everyday (one-time) debit card transactions when your available balance is not enough to cover. If we do not authorize and pay an overdraft, your transaction will be declined. What fees will I be charged if American Savings Bank (ASB) pays my overdraft? Managing your overdraft preferences for ATM and everyday debit card transactions · Under Bank Account Services on the main menu, select Overdraft Coverage. If we do not authorize and pay an overdraft, your transaction will be declined. , or visiting your online banking account at topooo.ru Opting in to Overdraft Coverage allows PNC to cover your ATM and everyday (one-time) debit card transactions when your available balance is not enough to cover. Online banking: Select your checking account and choose Account services. · Select Overdraft resources, then choose Overdraft coverage. · Choose Change coverage. The Additional Overdraft Privilege is not provided unless your account qualifies for, and you have not opted out of, the Standard Overdraft Privilege. For.

Studying For The Sie

SIE Exam Information · Securities Industry Essentials (SIE) Exam Overview & FAQs · More options · Settings · SIE Exam Difficulty Level · After the SIE · Our test prep. The SIE Exam preparation audio course prepares you for the essential knowledge to take the one comprehensive test, setting a unified standard for entry-level. This practice test is designed to give you examples of the types of questions that will appear on the actual exam. We've prepared a list of the best SIE Exam prep courses online. All of these courses come with some kind of SIE Exam textbook or SIE study guide PDF, as well. Prepare to pass the SIE exam, best-in-class study material. SIE textbooks, test banks and video training classes. We guarantee you pass. Pass your FINRA Securities Industry Essentials (SIE) exam with the help of the new SIE Exam Center app! Thousands of SIE questions, and their detailed. 5 Ways to Study for the SIE Exam · 1. Online SIE Course. · 2. Create a strict study schedule – and stick to it. · 3. Learn the language of finance. · 4. This SIE Exam Playlist is the most complete SIE Exam prep resource on YouTube. It has all the SIE Exam content you need to pass your SIE Exam. Use our free SIE study guide to prepare for your Securities Industry Essentials Exam. This online study guide is divided into four sections based on FINRA's SIE. SIE Exam Information · Securities Industry Essentials (SIE) Exam Overview & FAQs · More options · Settings · SIE Exam Difficulty Level · After the SIE · Our test prep. The SIE Exam preparation audio course prepares you for the essential knowledge to take the one comprehensive test, setting a unified standard for entry-level. This practice test is designed to give you examples of the types of questions that will appear on the actual exam. We've prepared a list of the best SIE Exam prep courses online. All of these courses come with some kind of SIE Exam textbook or SIE study guide PDF, as well. Prepare to pass the SIE exam, best-in-class study material. SIE textbooks, test banks and video training classes. We guarantee you pass. Pass your FINRA Securities Industry Essentials (SIE) exam with the help of the new SIE Exam Center app! Thousands of SIE questions, and their detailed. 5 Ways to Study for the SIE Exam · 1. Online SIE Course. · 2. Create a strict study schedule – and stick to it. · 3. Learn the language of finance. · 4. This SIE Exam Playlist is the most complete SIE Exam prep resource on YouTube. It has all the SIE Exam content you need to pass your SIE Exam. Use our free SIE study guide to prepare for your Securities Industry Essentials Exam. This online study guide is divided into four sections based on FINRA's SIE.

SIE Exam Prep Package: Online · days of instant access. · 12+ hours of video training that covers the exam prep manual chapter by chapter to ensure. FREE SIE Exam Prep content including over practice SIE exam questions, a PDF SIE Study manual section and video lecture instruction. The SIE Test will have 75 scored multiple-choice questions, spanning four sections: Knowledge of Capital Markets; Understanding Products and Their Risks;. Pass your FINRA Securities Industry Essentials (SIE) exam with the help of the new SIE Exam Center app! Thousands of SIE questions, and their detailed. r/Sieexam: Come here if you need help or just want to help others in their journey to pass the SIE Exam All are welcome. Crack the SIE Exam: Last-Minute Masterclass for passing the SIE Exam! · SIE exam and Series 7 exam Securities products and risks #sieexam #. Treat yourself to a new SIE textbook called a LEM (Licensing Exam Manual). I purchased their video series as well but never finished them. I. Our free SIE study guide covers all of the important topics and includes dozens of review questions. Start your SIE exam prep right here. Boost Your Exam Day Confidence. Securities licensing exam prep packages provide all the necessary tools to help you prepare, practice, and perform on the. The SIE exam is an introductory-level exam, designed to assess a candidate's knowledge of basic securities industry information. Pass the FINRA SIE on your first try with Achievable's online self-study course. Includes everything you need: easy-to-understand online textbook. Number of Questions: 75 · Format: Multiple Choice · Duration: 1 hour and 45 minutes · Passing Score: 70 · Cost: $ This course and study guide contains lessons that have been divided into 23 chapters. By exploring bite-sized lessons and utilizing other study materials. Three practice tests in the book and seven online in a convenient, online format. Made by Test Prep Books experts for test takers trying to achieve a great. The SIE Exam preparation audio course prepares you for the essential knowledge to take the one comprehensive test, setting a unified standard for entry-level. SIE Exam Prep - 3 Practice Tests and Study Guide Book for the FINRA Securities Industry Essentials Certification [6th Edition]: Rueda. The SIE exam contains 85 multiple-choice questions, 10 of which are unscored, and you will be given a time limit of 1 hour and 45 minutes. The 10 unscored. This comprehensive textbook is the foundation of your qualification exam preparation. The text contains everything you need to know for the exam, broken down. SIE Exam Prep: SIE Test Prep and Practice Test Questions for the FINRA Securities Industry Essentials Exam [2nd Edition]: Test Prep Books: SIE Exam Details · Exam Format. 75 graded multiple-choice + 10 experimental, ungraded questions · Duration. 1 hour and 45 minutes · Passing Score. 70%.

Codecademy Deals

Save 50% off Annual Pro & Plus Memberships for Military, Veterans, First Responders, Healthcare Workers, Teachers, and more at Codecademy! Shop smart at Codecademy! $10 Welcome Bonus when you join BeFrugal today. Find our latest discounts, sales, and promo codes in one easy place. Explore our built-in savings. Instantly save 50% when you pay annually. Save with hand-picked Codecademy discount codes from topooo.ru Use one of our 13 codes and deals for free shipping, 50% OFF, and more today! Get Working Codecademy Coupons, Discount Code, Promo Offers, Vouchers & Get Upto 50% Off On Online Training Courses For Individuals & Teams. Save $$$ at Codecademy with coupons and deals like: Get Up to 30% Off w/ Code LATER ~ Extra 15% Off Annual Plan with Code ~ Save 15% Off with Code LEX. With student pricing on Codecademy Pro, eligible college students can get complete access to our interactive curriculum for over 35% off the regular price. Get a free trial at Codecademy by signing up today. Take advantage of this sign up discount to save money when shopping online at Codecademy. Discover a range of Codecademy Promo Code valid for Save with Codecademy Coupon, courtesy of Groupon. Remember: Check Groupon First! Save 50% off Annual Pro & Plus Memberships for Military, Veterans, First Responders, Healthcare Workers, Teachers, and more at Codecademy! Shop smart at Codecademy! $10 Welcome Bonus when you join BeFrugal today. Find our latest discounts, sales, and promo codes in one easy place. Explore our built-in savings. Instantly save 50% when you pay annually. Save with hand-picked Codecademy discount codes from topooo.ru Use one of our 13 codes and deals for free shipping, 50% OFF, and more today! Get Working Codecademy Coupons, Discount Code, Promo Offers, Vouchers & Get Upto 50% Off On Online Training Courses For Individuals & Teams. Save $$$ at Codecademy with coupons and deals like: Get Up to 30% Off w/ Code LATER ~ Extra 15% Off Annual Plan with Code ~ Save 15% Off with Code LEX. With student pricing on Codecademy Pro, eligible college students can get complete access to our interactive curriculum for over 35% off the regular price. Get a free trial at Codecademy by signing up today. Take advantage of this sign up discount to save money when shopping online at Codecademy. Discover a range of Codecademy Promo Code valid for Save with Codecademy Coupon, courtesy of Groupon. Remember: Check Groupon First!

Find the latest Codecademy promo codes, coupons & deals for August - plus earn % Cash Back at Rakuten. Join now for a free $10 Welcome Bonus. The best Codecademy discount code available is 'OCTPROMO-STUDENT'. This code gives customers 79% off. How do you get 79% off at Codecademy? We have a coupon. These 32 Available Codecademy discount codes last updated TODAY can help you save Upto 50% OFF. Buy cheaper with Codecademy coupons & promo codes NOW! Shop at Codecademy, browse Coupons & Deals and Earn $ Cash Back with Swagbucks. Get a $10 bonus just for signing up for Swagbucks! Shoppers save an average of % on purchases with coupons at topooo.ru, with today's best discount being 15% off your purchase. Deal. 50%. 1 Month Free. Display coupon. Expires on 08/09/ Terms of Use. Coupon. Give these Just-Expired Codecademy Coupons & Deals a Go. Feel free to try. Get Working Codecademy Coupons, Discount Code, Promo Offers, Vouchers & Get Upto 50% Off On Online Training Courses For Individuals & Teams. Conditions Save over 35% on your Pro Annual Plan at Codecademy with Student Beans. Use our Codecademy student discount code at the checkout to enjoy over 35%. Ready To Enjoy Amazing Savings At Codecademy? Annual Subscription Up To 50% Off! 15% Off Any Order. Shop Your Favorites For Less! Get A 15% Discount All. Next prestige discount? 9 comments. r/newworldgame icon. r/newworldgame · Any discounts on the game? 7 comments. r/DougStanhope icon. r/. During the Codecademy Labor Day sale, customers can enjoy discounts ranging from 30% to 40% off. To maximize your savings on topooo.ru, be sure to check. Browse the most popular collection of Codecademy coupon codes & find the best discounts. Here's a log of the latest offers. Get amazing 50% Off discounts by using today's verified Codecademy coupon codes and offers. Select from all the 22 online Codecademy coupons which are. Codecademy promo codes, discounts and coupon codes valid for August Save online today with verified and working Codecademy coupons. Codecademy 50% discount is an evergreen discount on annual Pro and Plus memberships. It is available to the military, first responders, healthcare workers, and. topooo.ru has a dedicated merchandising team sourcing and verifying the best Codecademy coupons, promo codes and deals — so you can save money and time. If you want to use one of our promo codes, click and copy it. You may have added Codecademy products you need to your shopping bag, so just paste the code into. Our latest topooo.ru coupon codes for August PRO Annual Plan Was: $ N.. | Avail an Additional 15% Off Se.. | Take an Extra 15% Off Select. The best Codecademy discount codes is CELEBRATE This code gives customers 50% Off. What is the latest voucher codes from Codecademy? The latest voucher codes. CodeCademy Pro is offering a 50% discount. Not sure if this is allowed (I checked the community rules and it looks like it is?), but I got an.

Healthcare Financing For Bad Credit

/cloudfront-us-east-1.images.arcpublishing.com/dmn/VQTVMZKYXBBLVECIAWNZC46WME.jpg)

The CareCredit credit card can help pay for health, wellness, and medical costs with special financing options. Learn how it works and apply today! Change the conversation from the cost of treatment to what a patient can afford to pay. Low Cost to the Provider. Even if you have bad credit, you could still get a medical loan. Medical expenses are not reserved only for people with good credit, and if you have bad credit. PatientFi is easy to use for both the patient and the practice. Before PatientFi, we had low acceptance rates, and our patients didn't love the hard credit. Grow your medical practice with quick, low-rate funding. Loans terms Both good and bad credit scores can get approved by a lender. Apply for Term. A medical loan is a type of personal loan designed to help people finance medical expenses. Some people use medical loans when their treatment is not fully. Chiropractic Patient Financing For Good & Bad Credit · Braces Financing · Boat Slip Financing · Plumbing Financing For Good & Bad Credit · Kitchen Remodel. Health & wellness financing for you and your family · No Annual Fee · Promotional financing options* available in the CareCredit Network · Accepted at ,+. A medical loan for when you need it most · Check your rate in 5 minutes. · Get funded in as fast as 1 business day.² · Apply for a loan from $1, to $50,³. The CareCredit credit card can help pay for health, wellness, and medical costs with special financing options. Learn how it works and apply today! Change the conversation from the cost of treatment to what a patient can afford to pay. Low Cost to the Provider. Even if you have bad credit, you could still get a medical loan. Medical expenses are not reserved only for people with good credit, and if you have bad credit. PatientFi is easy to use for both the patient and the practice. Before PatientFi, we had low acceptance rates, and our patients didn't love the hard credit. Grow your medical practice with quick, low-rate funding. Loans terms Both good and bad credit scores can get approved by a lender. Apply for Term. A medical loan is a type of personal loan designed to help people finance medical expenses. Some people use medical loans when their treatment is not fully. Chiropractic Patient Financing For Good & Bad Credit · Braces Financing · Boat Slip Financing · Plumbing Financing For Good & Bad Credit · Kitchen Remodel. Health & wellness financing for you and your family · No Annual Fee · Promotional financing options* available in the CareCredit Network · Accepted at ,+. A medical loan for when you need it most · Check your rate in 5 minutes. · Get funded in as fast as 1 business day.² · Apply for a loan from $1, to $50,³.

You can also use a medical loan to consolidate medical bills. If you qualify for a loan with a low interest rate, you could simplify your monthly budget and. Loans for Nurses with Good or Bad Credit. Personal loans for nurses are available and as a nurse, you should have some advantages when qualifying. bad credit or you've been turned down for credit recently.” What type of procedures can I finance? Medical loans can be obtained for a variety of procedures. Can I qualify for a healthcare loan if I have bad credit? Can I get a medical loan with bad credit? Customers who take out personal loans for medical expenses through Avant typically have credit scores between and. We offer a wide range of medical practice loans and alternative funding, even medical loans for bad credit through our marketplace of alternative lenders that. Patient financing with HSF® offers patients an affordable payment option over a longer term. It reassures patients with a low or no interest loan program and. Borrow Money. Borrow up to $40, at an interest rate as low as % APR (depending upon credit). Apply Now. The best personal loans for nurses and other health care providers require good to excellent credit, yet personal loans for those with bad credit also exist. With Momnt, your patients can shop a variety of offers without impacting their credit score. UI Component showing a customer's inormation, including income and. If you're in healthcare and looking for help with funding or consolidating debt Flexible Terms. 3 to 10 years. Low fixed monthly payments. However, this does not mean that a person with bad credit cannot get much-needed surgery loans for bad credit. Companies, like United Medical Credit (UMC). For borrowers with poor credit, Avant is a better option. Avant offers loans to anyone with a minimum score of Rates are roughly double those offered by. With large loan amounts and low payments, a loan from BHG Financial makes it easy for medical professionals, like you, to capitalize on personal and. While you are trying to recover strength, you also have to cover your bills, but your credit score is low. Fortunately, there is a medical loan in case of a bad. Most healthcare professionals turn to healthcare financing because they've had bad luck getting approved by traditional banks or they want a cheaper cost of. HOW TO SECURE PERSONAL LOANS FOR HEALTHCARE WORKERS WITH BAD CREDIT? · Secured personal loans – These loans are backed by collateral, thus providing additional. Credit Cards Low Intro APR Credit Card Cash Back Credit Card Travel Credit Card Credit Building Card View All Credit Cards · Debit Cards Everyday Debit Card. Bad Credit Medical Loans · Medical Practice Financing. Loan Rates. Medical Loan Healthcare financing through American Medical Loans gives you up to. General Healthcare · Lasik & Vision · Medical Devices · Weight Loss. Pet LendingUSA helps you get easy financing with low monthly payments – so you.

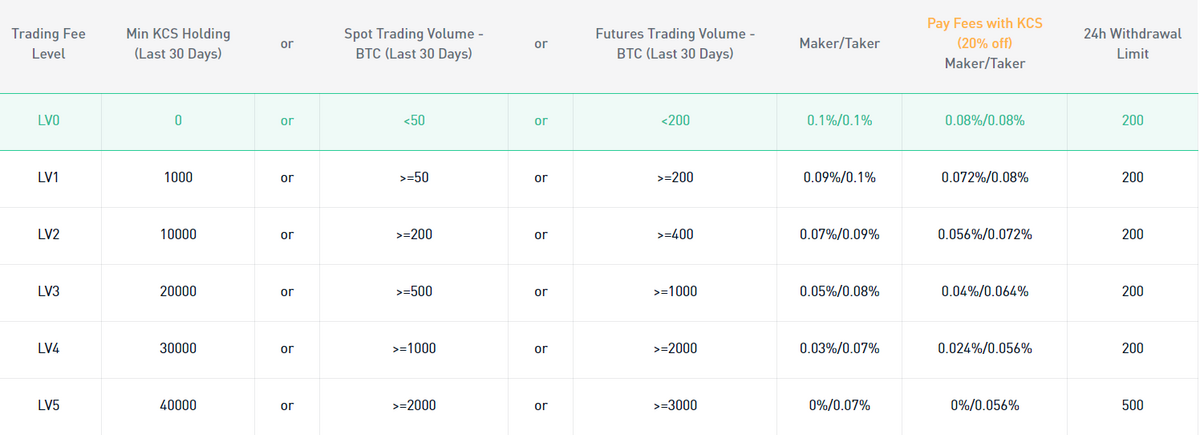

Kucoin Fees

Kucoin withdrawal fees compared to 22 exchanges, by nominal and fiat value, as of Aug 23, Bitcoin: BTC ($), Ethereum: ETH ($). KuCoin Futures Fee Structure:Maker FeeTaker FeeDescriptionTrading FeeFloating fee rate%Floating fee rate%Settlement Fee%Settlement Fee will. The maker-taker fees on Binance range from 0% to %. Kucoin has a flat fee of % for all trades, regardless of whether you are a maker or a. The 12 fee levels ; LV8. or. >= or ; LV9. or. >= or ; LV or. >= or. KuCoin deducts the token after slash of a trade pair as the fee token. For example, users will pay USDT/KCS as the trading fee token for BTC/USDT, LTC/KCS. The KuCoin app is available for Android and iOS mobile devices. You will immediately notice the difference in UX (user experience) between the web and mobile. KuCard Fee Schedule ; Apply for a physical card. per card. VIP 0. EUR for the 1st one. EUR for the 2nd one. VIP 1 or above. EUR for the 1st one. When choosing an exchange, traders often weigh features like fees, cryptocurrency variety, and trading tools. This article compares KuCoin and Phemex. Kucoin withdrawal fees compared to 22 exchanges, by nominal and fiat value, as of Aug 23, Bitcoin: BTC ($), Ethereum: ETH ($). Kucoin withdrawal fees compared to 22 exchanges, by nominal and fiat value, as of Aug 23, Bitcoin: BTC ($), Ethereum: ETH ($). KuCoin Futures Fee Structure:Maker FeeTaker FeeDescriptionTrading FeeFloating fee rate%Floating fee rate%Settlement Fee%Settlement Fee will. The maker-taker fees on Binance range from 0% to %. Kucoin has a flat fee of % for all trades, regardless of whether you are a maker or a. The 12 fee levels ; LV8. or. >= or ; LV9. or. >= or ; LV or. >= or. KuCoin deducts the token after slash of a trade pair as the fee token. For example, users will pay USDT/KCS as the trading fee token for BTC/USDT, LTC/KCS. The KuCoin app is available for Android and iOS mobile devices. You will immediately notice the difference in UX (user experience) between the web and mobile. KuCard Fee Schedule ; Apply for a physical card. per card. VIP 0. EUR for the 1st one. EUR for the 2nd one. VIP 1 or above. EUR for the 1st one. When choosing an exchange, traders often weigh features like fees, cryptocurrency variety, and trading tools. This article compares KuCoin and Phemex. Kucoin withdrawal fees compared to 22 exchanges, by nominal and fiat value, as of Aug 23, Bitcoin: BTC ($), Ethereum: ETH ($).

The exchange didn't charge for these transactions, which makes this method ideal for this group of traders. Pros, Cons. No fees for crypto deposits and. KuCoin uses a tiered fee structure for regular spot trading, with the lowest level (tier 0) having a maker fee of % and a taker fee of %. Trade the cryptocurrencies of your choice on the KuCoin exchange with leverage as high as x The platform only charges a % fee per trade, making their. Competitive Rates: The standard % fee is already lower than many mainstream exchanges, making KuCoin an attractive option for cost-conscious. Maker/taker fees are lowered to % when paid with the KCS token. Level 5 clients (with 40, KCS or a day trading volume between 2, and 4, {BTC -. KuCoin offers a tiered maker/taker fee model, with trading fees ranging from %%, depending on your tier level. Its fees are relatively. Welcome to KuCoin! One of the world's leading blockchain and crypto exchanges, trusted by over 30 million registered users across more than countries. KuCoin is a secure cryptocurrency exchange that allows you to buy, sell, and trade Bitcoin, Ethereum, and + altcoins. The leader in driving Web Welcome to KuCoin! One of the world's leading blockchain and crypto exchanges, trusted by over 30 million registered users across more than countries. What Are KuCoin Fees? ; Class A, %, % ; Class B · %, % ; Class C · %, %. 2. Subscription Fees: Subscription fees are charged when users subscribe tokens. Currently, the fee rate is % per subscription. KuCoin offers a tiered maker/taker fee model, with trading fees ranging from %%, depending on your tier level.6 Its fees are relatively low compared. Compare Kucoin vs topooo.ru side-by-side to learn which crypto exchange is a better choice in regards to their fees & features. Likewise, KuCoin does not charge deposit fees for crypto. Because the platform does not support fiat deposits, they will charge a fee of 3% to 12%, depending on. Overview. KuCoin is a cryptocurrency exchange based in Hong Kong. It offers one of the most trading pair selections- over different pairs, and supports. KuCoin uses a taker - maker fee model for determining its trading fees. Orders that provide liquidity ("maker orders") are charged different fees than. Trading Fee Calculation. In the KuCoin Futures trading, the following factors will affect your fee rate: 1. Trading Fee Level: To view your current trading fee. What Are KuCoin Fees? ; Class A, %, % ; Class B · %, % ; Class C · %, %. KuCoin App Experience · Enabling access with Face ID (both for Android and iOS users) · Anti-Phishing Safety Phrase · Refer friends and receive rewards through. Imagine this: you're riding the wave of a crypto bull market, your portfolio is flourishing, and then BAM! Hefty trading fees start eating.

How To Fix Javascript Errors In Google Chrome

Issues: Find and fix problems Use the Issues panel to find solutions to problems detected by the browser, such as cookie issues and mixed content. An error. You will find more details about the error in the browser console. Go to that script and troubleshoot from there. In order to open the browser developer tool. Open Chrome on your computer. · Click More then Settings. · Click Privacy and Security. · Click Site settings. · Click JavaScript. · Select Sites can use Javascript. Identify the Error for Chrome, Edge, Firefox and Safari · The error console will open. · The console will provide you with the error type, the location of the. Within the Chrome browser, you go View > Developer > Javascript Console. The console will show you significant errors such as when a file is. If you open up Chrome Dev Tools you should see a console at the bottom. Most errors will appear there, errors dealing with syntax, variables. Read this guide to learn how you can identify and fix Search-related JavaScript problems that may be blocking your page or content from Google Search. Once you've opened the console, reload the page which is causing the error or otherwise not working as expected. Information should appear in the console, like. Open Chrome. · Hit F12 · Click on 'Console Settings'. · Check 'Preserve log'. · And you are done! Issues: Find and fix problems Use the Issues panel to find solutions to problems detected by the browser, such as cookie issues and mixed content. An error. You will find more details about the error in the browser console. Go to that script and troubleshoot from there. In order to open the browser developer tool. Open Chrome on your computer. · Click More then Settings. · Click Privacy and Security. · Click Site settings. · Click JavaScript. · Select Sites can use Javascript. Identify the Error for Chrome, Edge, Firefox and Safari · The error console will open. · The console will provide you with the error type, the location of the. Within the Chrome browser, you go View > Developer > Javascript Console. The console will show you significant errors such as when a file is. If you open up Chrome Dev Tools you should see a console at the bottom. Most errors will appear there, errors dealing with syntax, variables. Read this guide to learn how you can identify and fix Search-related JavaScript problems that may be blocking your page or content from Google Search. Once you've opened the console, reload the page which is causing the error or otherwise not working as expected. Information should appear in the console, like. Open Chrome. · Hit F12 · Click on 'Console Settings'. · Check 'Preserve log'. · And you are done!

JavaScript Errors in Google Chrome · In Google Chrome, go to View → Developer → JavaScript Console (Press Ctrl-Shift-I for Windows). · The error console will open. The first step is to exclude the JavaScript files from delay. You can find these in the network tab Chrome DevTools or using a tool with a waterfall view like. 4. Does the error message still appear? Let's check the console for more information. Google Chrome's Debug (Developer) console is a powerful tool that can help. Open the webpage · Open Chrome developer tools for that webpage · In Sources panel go to Overrides tab · Click Select folder for overrides and. Within the Chrome browser, you go View > Developer > Javascript Console. The console will show you significant errors such as when a file is. Read this guide to learn how you can identify and fix Search-related JavaScript problems that may be blocking your page or content from Google Search. Troubleshooting JavaScript errors · Open the DevTools Console tab to keep track of eventual JavaScript errors. · Check the stack trace of the error by simply. Use In-Browser Developer Tools. By far the most useful tools at our disposal for fixing JavaScript errors are the in-browser developer tools. Previously, when I. You will find more details about the error in the browser console. Go to that script and troubleshoot from there. In order to open the browser developer tool. Google Chrome · On the web browser menu click on the "Customize and control Google Chrome" and select "Settings". · In the "Settings" section click on the "Show. JavaScript site for Google Search. Googlebot Here's an example that shows how to log JavaScript errors that are logged in the global onerror handler. To open the Developer Tools, select the menu icon > More Tools > Developer Tools. To open the JavaScript Console, press the ESC key on your keyboard. The ESC. The only solution for this as I found is to re install chrome browser. Anyway, after few days again not working. For example I have reinstalled chrome 1 week. Why don't people, even at such highly-visited sites like google, care about those errors? The problem with javascript is that all these errors. Open the Developer Options setting on your Android Device. · Select Enable USB Debugging. · On your development machine (desktop), open Chrome. Make sure you are on the latest version of AIOSEO (and all addons) · Try clearing your cache, then reloading the page. · Test in a Chrome Incognito or Firefox. Google Chrome and Firefox extension that notifies about JavaScritp errors by icon in address bar & popups - barbushin/javascript-errors-notifier. Windows · Open Google Chrome and choose Customize > Tools > Developer Tools. · To close the Developer Tools click the Close button found on the right hand side of. This issue is triggered when pages have JavaScript errors that are captured in the Chrome DevTools console log during page rendering. How To Fix. Review pages. Depending on your browser its naming is slightly different, but following Chrome and Firefox, we'll call it the 'Console'. Every browser has a different way of.

Types Of Graduate Student Loans

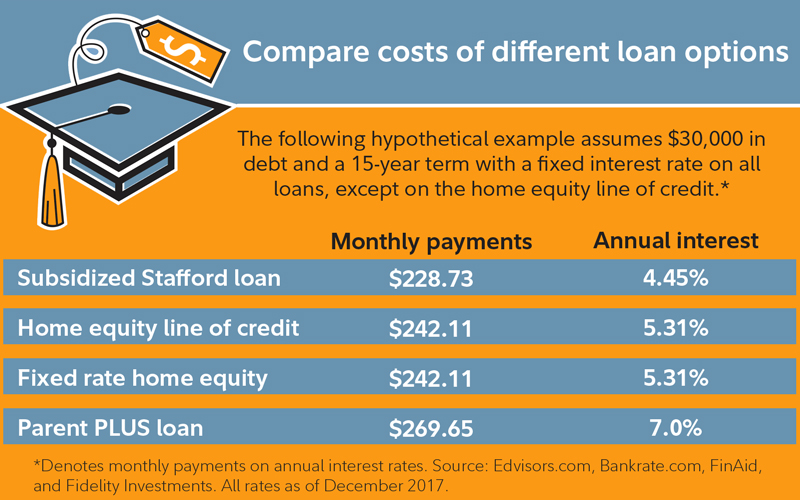

Private student loans or alternative loans are available to students who are not eligible for federal loans or who need assistance beyond their financial aid. Grad students can apply for federal and private loans. Federal loans are funded by the federal government, and you apply for Federal Direct Loans and Direct. Loans for Graduate Students · Federal Direct Unsubsidized Loan · Federal Direct Graduate / Professional PLUS Loan · Private (Alternative) Education Loans. How are graduate school loans different? Graduate school loans and financial aid are very different than undergrad. Now that you're considered an independent. Most students pay for grad school using a combination of savings, scholarships, grants, fellowships, assistantships, and student loans. Depending on your school. Federal Loans ; Borrower, Graduate and Professional Students enrolled at least half-time. They do not need to demonstrate financial need. Graduate and. The best student loan type is the Direct Subsidized Loan, which is available to undergraduate students with financial need. The government covers interest while. Graduate or Professional Students: $, - No more than $65, of this amount may be in subsidized loans. The graduate debt limit includes all federal loans. The federal Direct unsubsidized loan is available to graduate students who are U.S. citizens or eligible noncitizens enrolled at least half-time in a degree-. Private student loans or alternative loans are available to students who are not eligible for federal loans or who need assistance beyond their financial aid. Grad students can apply for federal and private loans. Federal loans are funded by the federal government, and you apply for Federal Direct Loans and Direct. Loans for Graduate Students · Federal Direct Unsubsidized Loan · Federal Direct Graduate / Professional PLUS Loan · Private (Alternative) Education Loans. How are graduate school loans different? Graduate school loans and financial aid are very different than undergrad. Now that you're considered an independent. Most students pay for grad school using a combination of savings, scholarships, grants, fellowships, assistantships, and student loans. Depending on your school. Federal Loans ; Borrower, Graduate and Professional Students enrolled at least half-time. They do not need to demonstrate financial need. Graduate and. The best student loan type is the Direct Subsidized Loan, which is available to undergraduate students with financial need. The government covers interest while. Graduate or Professional Students: $, - No more than $65, of this amount may be in subsidized loans. The graduate debt limit includes all federal loans. The federal Direct unsubsidized loan is available to graduate students who are U.S. citizens or eligible noncitizens enrolled at least half-time in a degree-.

Stafford Loans are the most common federal loan that students use to help pay for college or graduate school. Here are the current borrowing limits: For. There are four types of Direct Loans: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans. Direct Subsidized. Graduate students should max out federal unsubsidized loans before turning to federal PLUS or private loans to cover their remaining costs. Federal loans like Direct Unsubsidized and Grad PLUS are usually solid choices. They offer flexible repayment options, which can be really handy. There are two main types of loans for graduate students: federal loans and private loans. Graduate students can borrow federal and private student loans. Federal student loans include Direct Unsubsidized Loans and Grad PLUS Loans. Types of Graduate Loans · Federal Loans. Direct Loans. Federal student loans offered by the U.S. Department of Education (ED) to help eligible students cover the. Federal Direct Student Loans · Subsidized Loans. Subsidized Federal Direct Loans are awarded to undergraduate students ONLY. · Unsubsidized Loans. Unsubsidized. As a graduate student there are several types of financial aid that may be available to assist you with funding your graduate/professional education. You must be a degree-seeking graduate student, as named by the Graduate School and enrolled at least half time (five credit hours) or conditionally admitted. While there are several ways to borrow money, the two general types of loans specifically designed for graduate students are federal loans and private loans. We. Federal Student Loans Issued Today · Direct Subsidized Loans (for undergraduate study) · Direct Unsubsidized Loans · Direct Parent PLUS loans · Direct Graduate PLUS. 7 of the best graduate student loan lenders · Ascent · Citizens Bank · College Ave · EDvestinU · INvestEd · MEFA · Sallie Mae. The Graduate PLUS loan is an unsubsidized loan available to graduate/professional students to help pay for educational expenses that are not covered by other. A federal loan available to graduate and professional students. You must be enrolled at least half time to be eligible. The federally-set limit for this. Federal Direct PLUS Loan for Graduate and Professional Students · % fixed interest rate during repayment for loans first disbursed from July 1, There are four types of Direct Loans: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans. Direct Subsidized. As a graduate student, you have the option to take out federal direct unsubsidized loans, graduate PLUS loans or private student loans. Federal Direct Unsubsidized Loans: Federal Direct Unsubsidized Loans are available for students who do not demonstrate need or who have exhausted their need-. Types of Federal Student Loans · Direct Subsidized Loans · Direct Unsubsidized Loans · Parent PLUS Loans · Graduate PLUS Loans · Direct Consolidation Loans.